Hyperinflation and The Dollar

Most people know that the purchasing power of the dollar has dropped substantially over the last 10-15 years. Financial pundits like Peter Schiff and Lynette Zang publish video after video about inflation, the death of the dollar, and the importance of hard money like Gold. Many wonder if they’re right and sooner or later the dollar will collapse.

To many, it makes sense that the dollar could enter hyperinflation because that is what happens to fiat currency when governments print too much money, but the dollar is unlike any other currency in the history of the world because it acts as a universal currency for international trade as well as a reserve currency for foreign central banks.

Enter Brent Johnson of Santiago Capital and the Dollar Milkshake Theory:

Here’s how Brent’s Dollar Milkshake Theory “shakes” out:

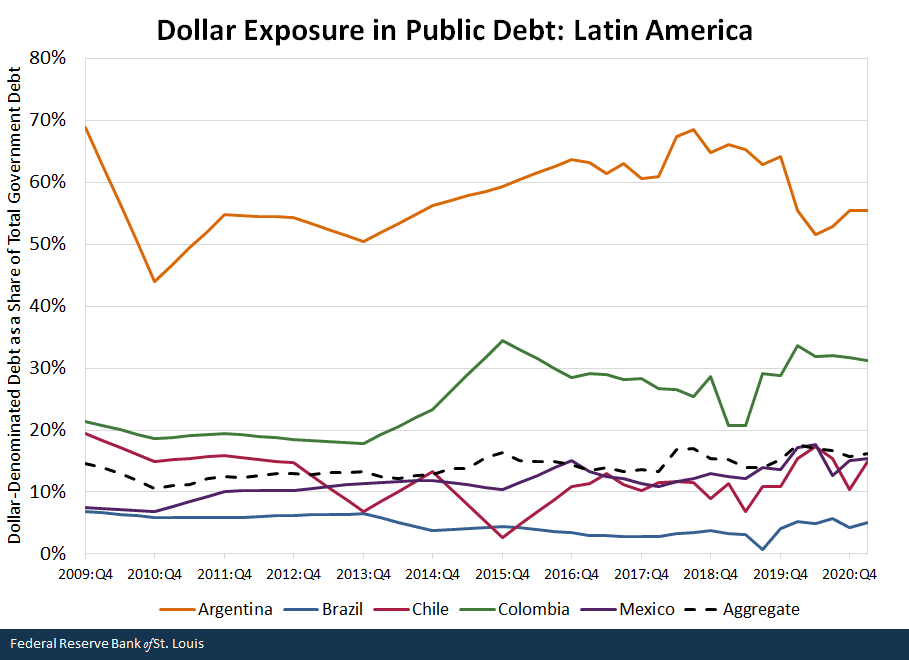

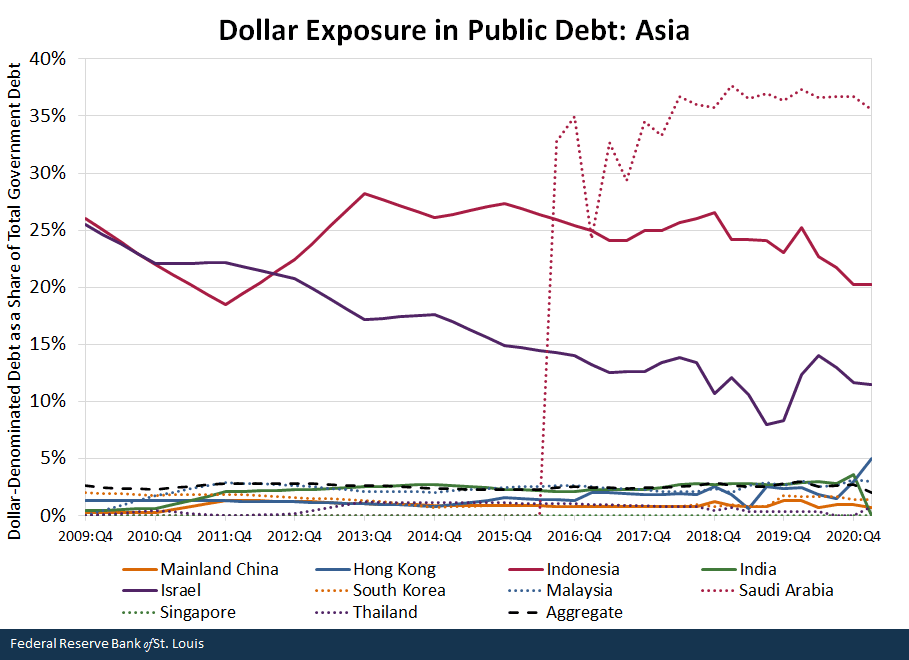

Countries around the world use dollars but can’t print them. They borrow and lend dollars, use them to buy and accept them when they sell. They put dollars and treasury bonds in their central bank reserves. They need dollars to pay their debts. Many countries have trillions in loans made between themselves which are denominated in dollars.

Countries who need dollars can get them in one of two ways. They can export products and sell them for dollars or they can debase their currency by printing their currency and buying dollars on the open market. Printing their money weakens their native currency against the dollar and weakens the value of their exports which increases the likelihood that they will need to print more of their currency in the future to service their debt, buy imports, etc.

Brent Johnson believes that the milkshake was mixed when central banks around the world injected 20 trillion dollars into the global economy during the 2008 financial collapse, and countries did it again in 2020 due to Covid. That amounted to an additional 14T of liquidity. The US printed a ton of new money during these times, but the US was eventually able to slow their stimulus programs and raise rates. This was done while many countries were still using negative interest rates.

The stronger the dollar gets against other currencies, the harder it is for those countries to repay their dollar denominated debts, buy dollar denominated commodities, and trade their exports for dollars.

The dollar can strengthen through many mechanisms, we discussed the inflation of a foreign currency against the dollar, essentially a foreign government prints their currency at a rate which exceeds the inflation of the dollar.

Another way is if the US economy is strong, if our treasury rates are higher than other nations, if our stock market or real estate market is booming, demand for the dollar increases as nations, foreign companies, and foreign individuals demand dollars to buy American assets, like shares of stock, treasury bonds, and real estate.

According to the theory, this creates a self reinforcing cycle where the dollar continues to rise against foreign currencies, sucking the liquidity out of foreign countries until eventually it causes a global credit crisis.

The dollar, specifically, dollar denominated debt, is a trojan horse that slowly drains the liquidity out of every country that holds debt in our currency. To prevent a global liquidity crisis requires America to constantly debase the dollar in order to keep global markets liquid, but this causes inflation in the US, and saddles tax payers with massive public debts.

It is possible to have not enough dollars in the world but too many here at home. Our economy acts as a magnet, pulling foreign dollars back into the U.S. which creates high prices for assets like real estate, equities, and labor.

The End Game

When Brent started talking about this, it looked as if it would happen sooner rather than later, but global markets lucked out when another global catastrophe occurred which prompted the Federal Reserve and other central banks to inject trillions into the markets again during covid.

This injection mildly weakened the dollar but it has strengthened again and is in a strong upward trend yet again.

A crisis initially helps weaken the dollar when the government prints dollars to respond to it, but it also causes people to demand dollars as a hedge against their own currency inflation.

It seems that no matter what the US does to weaken the dollar it resumes its upward trend and starts to stress credit markets.

President Pump, Tariffs, and Tax Cuts

Since the Election, the dollar has strengthened from 103 to 106. These figures are relatively neutral but over a short period of time the dollar’s trend has been impressive.

The stock market, crypto, and even metals have all posted strong gains and new highs in the wake of Donald Trump emerging as winner.

To investors, Donald Trump’s presidency appears to be good news for the buck. Trump is pledging to cut spending, cut taxes, increase tariffs, and expel millions of migrants. Some of these could be chaotic to international markets and to the American economy, and overall they could lead to both more inflation and a stronger dollar.

It will be interesting to see how it all shakes out, but after learning about the function of the dollar in global markets, I think that the best assets are equities in companies with low international exposure, U.S. real estate, precious metals and bitcoin. I also think the antiques and collectibles markets will continue to appreciate faster than many other assets.

I’m less afraid of the dollar being replaced in global economies. I do believe the dollar will be replaced, not in name but the underlying mechanics of how it works will need to change when the global debt crisis arises. While we don’t know when it will happen, we can be prepared for it to happen by making sure we de-risk our stock portfolios with metals like gold and silver, bitcoin, and real estate.

I also believe that it’s wise to invest time and money into building community, planting gardens, acquiring data and knowledge, building skills, and developing the right mindset to survive difficult times.